The International Monetary Fund (IMF) has just released its October 2025 World Economic Outlook — and the message is clear: while the near-term picture has improved slightly, global growth remains subdued as economies adjust to a complex mix of slowing trade, high borrowing costs, and uneven recovery across regions.

🔗 Read the full report or download full report (PDF)

Key Highlights & Findings

Growth & Inflation Outlook

- The world economy is seen as being in flux, with prospects “dim.”

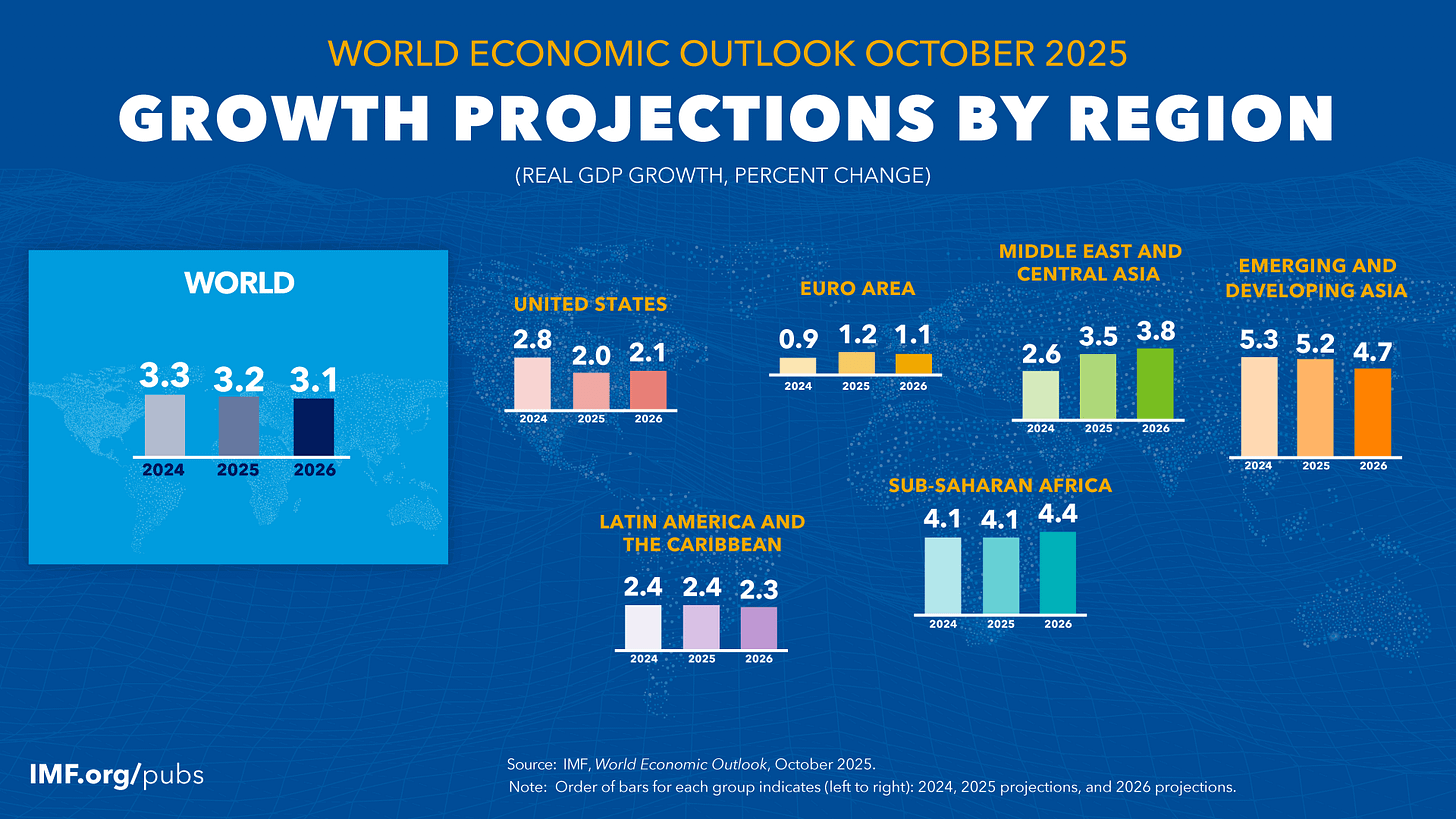

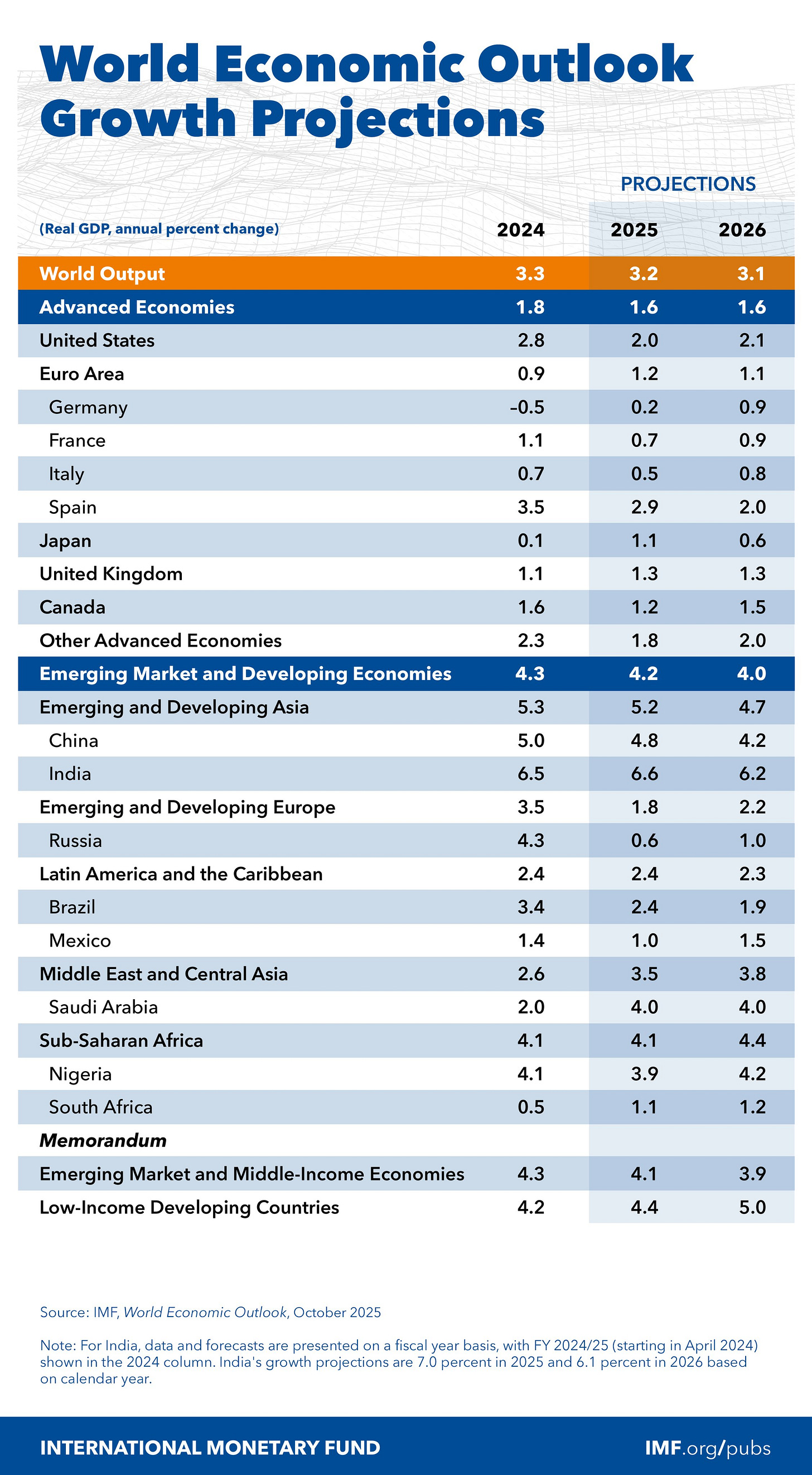

- Global growth is projected at 3.2 % in 2025, down from 3.3 % in 2024, and slowing further to 3.1 % in 2026.

- Advanced economies are forecast to grow by about 1.5 %, while emerging market and developing economies will see just over 4 % growth.

- Inflation is expected to gradually decline in many countries, though it will remain above target in the U.S., with upside risks.

Risks & Vulnerabilities

- The balance of risks is strongly tilted to the downside.

- Threats include:

- Rising protectionism and trade fragmentation

- Policy uncertainty and political instability

- Fiscal vulnerabilities and high public debt

- Financial market corrections, especially if risk premia widen

- Labor supply shocks, especially in aging or low-growth economies

- Erosion of institutional credibility (e.g. loss of central bank independence)

Emerging Markets & Resilience

- Some emerging markets have held up better than expected — due partly to “good luck” in external conditions, but also improved policy frameworks.

- Countries with strong institutional and policy frameworks are in a better position to absorb shocks.

- In weaker economies, delayed monetary tightening or overdependence on foreign exchange interventions may lead to inflation de-anchoring and higher output losses.

Industrial Policy & Trade-Offs

- Chapter 3 evaluates how industrial policy is increasingly being used to build resilience and reduce import dependence.

- But such policies carry trade-offs: potential distortions, fiscal costs, and inefficient resource allocation.

- Their success depends heavily on targeting, institutions, structural reforms, and complementarity with macroeconomic policy.

Policy Recommendations

- Restore confidence through credible, transparent, and sustainable policies.

- Couple trade diplomacy with macroeconomic adjustment.

- Rebuild fiscal buffers and avoid overreliance on debt.

- Safeguard central bank independence and sound institutional frameworks.

- Emphasize structural reforms, especially in weaker economies, to improve resilience.