The U.S. IPO market has experienced a significant rebound, with 242 IPOs completed by mid-September 2025, marking an 80.6% increase compared to the same period in 2024. After years of waiting, tech firms are rushing to list. The question isn’t why it’s happening. It’s why it took this long.

Already IPO’d in 2025

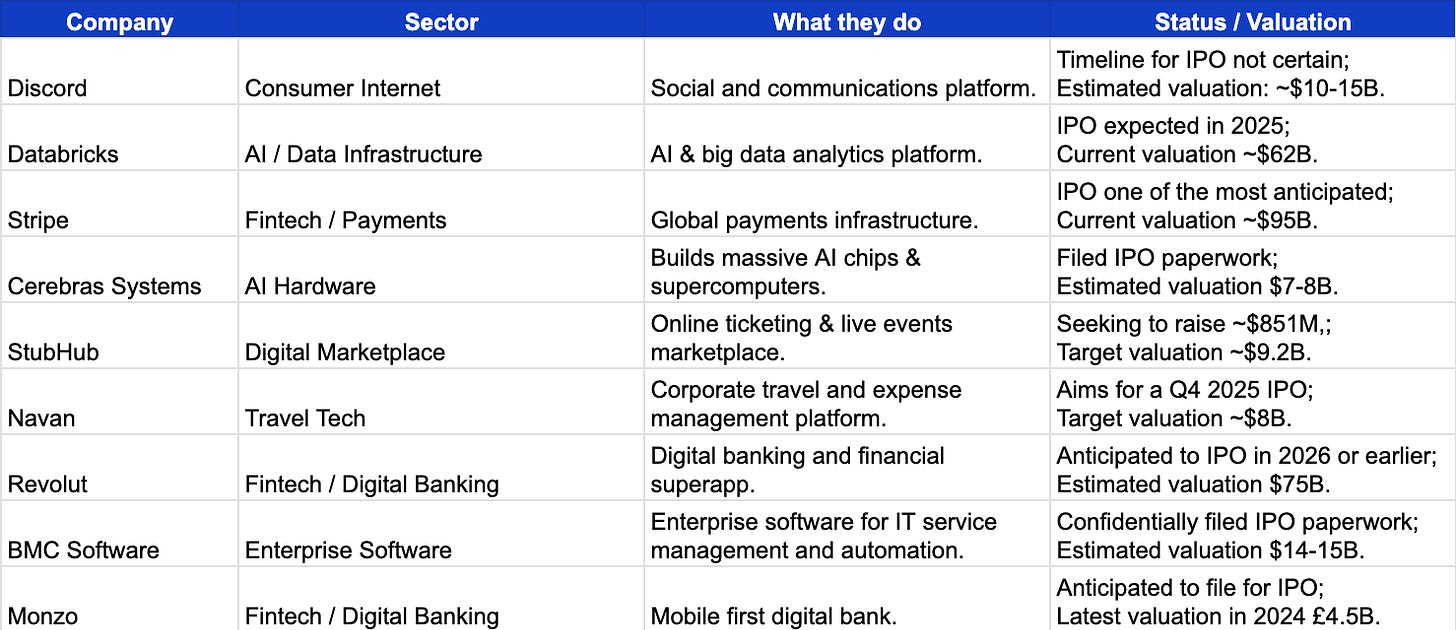

IPOs to watch for the remainder of 2025

A few forces came together to create this window.

1. Optimistic Market Conditions

The IPO market has experienced a significant rebound, with 242 IPOs completed by mid-September 2025, marking an 80.6% increase compared to the same period in 2024. This resurgence is driven by improved investor sentiment, strong equity markets, and standout debuts from high-growth tech companies like Klarna and Figma.

2. Pent-Up Supply Breaking Loose

2024 was one of the weakest IPO years in a decade. Companies burned through private capital while waiting out rate hikes and market volatility. That capital is running thin and boards know this is the moment to raise funds before conditions tighten again. Goldman Sachs just had its busiest IPO week since 2021.

3. Regulatory Support and Market Confidence

Regulatory bodies are facilitating the IPO process. For instance, India’s Securities and Exchange Board (SEBI) has expedited IPO approvals, aiming to boost market activity and potentially reach a record for fundraising in 2025. Additionally, the U.S. market has seen a resurgence, with major listings raising over $4 billion in a single week.

4. Anticipation of Market Challenges Ahead

Companies are aware of potential challenges in the upcoming year, including economic uncertainties and regulatory changes. By going public now, they aim to secure capital and establish a market presence before these potential obstacles arise.

According to the Financial Times, Klarna was the eighth U.S. IPO in 2025 to raise over $1 billion, up from seven for all of 2024 but still well below the 28+ billion-dollar deals seen in 2021.